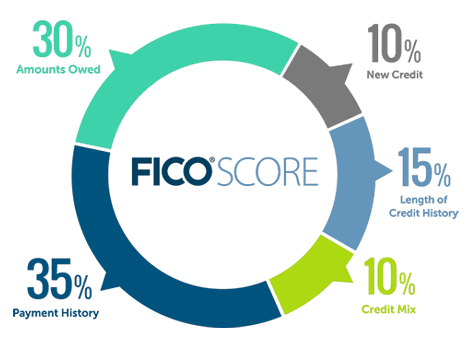

There are a lot of misconceptions about credit scores. Do you know the 5 things that matter?

Payment history (35%) – This is your track record of paying back what you borrowed. Accounts in collection, late payments, and bankruptcy are bad; paying on time for a long period is good

Amounts owed (30%) – This is based on the total amounts you owe, and the ratio of what you’re allowed to borrow to what you currently owe, called your “utilization ratio.” Maxing out your credit hurts it; keeping a lot of unused credit available helps it.

Length of credit history (15%) – This considers the length of time each credit account has been open, and when each account was last updated with payment or usage info. Credit accounts with “gray hair” are a plus.

New credit (10%) – This includes recent inquiries and requests for credit. Regularly applying for new credit cards or other loans will cost you.

Types of credit used (10%) – There are all kinds of credit out there, from revolving (credit cards) to installment (car and home loans.)

Want to know a bit more…Check out this great article I came across – Click Here

With over thousands of transactions, we have learned a thing or two, and we work harder to make sure that those lessons learned work to your benefit. So, give me a call at 317-625-0655 when the time is right.