Posts tagged with "financing"

Planning to Buy a Home? These White Lies Can Jeopardize Your Chances

Have you heard the saying, “honesty is the best policy?” That’s generally true in life—but it’s especially true when it comes to real estate.

If you’re buying a home, lying to your lender—even a “harmless” white lie—could jeopardize the whole deal. And while you should refrain from telling any lies, there are certain ones that are almost certain to cause issues with your real estate purchase.

So what, exactly, are those lies? A recent article from realtor.com outlined the white lies that could destroy your chances of successfully buying a home, including:

- Saying you’re going to live in the home, when you’re actually planning to rent it out. If you’re planning to buy a house as a rental property (whether for a short-term or long-term rental), you need to disclose it. If you don’t, it could be considered mortgage fraud—which can result in a felony charge.

- Not being honest about where your down payment money is coming from. It’s certainly not uncommon for buyers to get financial help when they’re buying a home. But if someone (for example, a parent) has gifted and/or loaned you money to cover your down payment, you need to let your lender know. Generally, it won’t be a problem—but if you lie about where the money came from, that could end up being a problem.

- Leaving out debts. When you apply for a mortgage, you need to disclose every single debt, no matter how big or small. Your lender will discover the debt during the underwriting process—and if they find out you knowingly lied, it could cost you your mortgage.

Have questions on Financing…Check out our Financing Section. And if you want to talk to a real person, give me a call at (317) 625-0655!

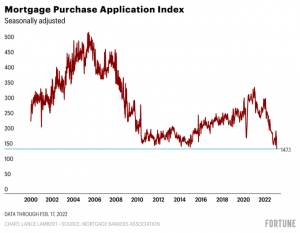

Down 41.5% Nationwide

Did you know Mortgage Purchase applications are down 41.5% from a year ago nationally? To no one’s surprise, this translates to fewer home sales.

Did you know Mortgage Purchase applications are down 41.5% from a year ago nationally? To no one’s surprise, this translates to fewer home sales.

Here in Indiana, we are feeling a little bit of pain. Sales in the local Indy area were down really close to that in January.

But what may surprise you is that We are BUSY Selling Homes. And closing in less than 30 days. In fact, Top Choice Real Estate just had its BEST February ever (that’s over a 40- year period.)

What does that mean for you:

This is not our first rodeo. With over 40 years of experience, we have seen uncertain times like this (and it was NOT in 2018). Yet, we have navigated these waters successfully and created wins for our clients.

Call or text us at 317-625-0655 today. Let us show you what we can do for you!