Is January the new April? When it comes to the real estate market, experts say yes.

Whether that famous groundhog sees his shadow, experts suggest Spring will arrive early this year—at least when it comes to the housing market. In fact, some are speculating that January may very well be the new April.

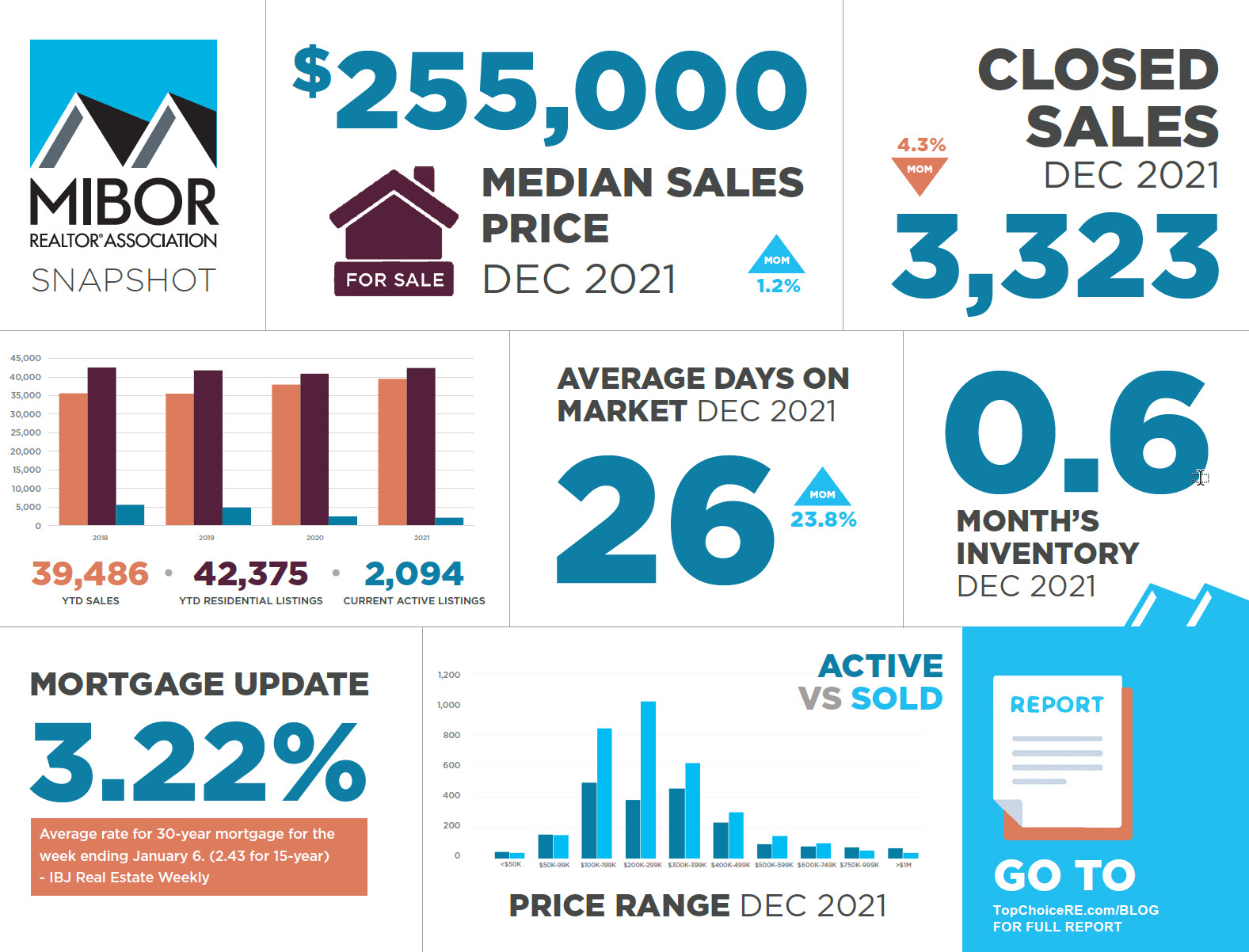

What’s causing this already-busy buying season to kick-off ahead of schedule? Low inventory and rising home prices are spurring house hunters to come out of hibernation months before they previously would have.

With that in mind, the following checklist will help you prepare yourself if this is the year for purchasing your dream home.

Preparing To Buy

If you’re ready to purchase a new home, there are several things you can do to make sure the process goes as smoothly as possible.

Clean up your credit: Your credit score not only impacts your ability to secure a mortgage at all, but it will also determine the interest rate you’ll pay. If you’re worried about your credit score, start working toward raising it by paying all your bills on time and making sure your balances are low. Check your credit report by contacting the three credit bureaus: Experian, Equifax, and TransUnion. You’re entitled to a free report from each agency once per year. Having the information amended will boost your score if you spot an error.

Get pre-approved for a mortgage: Getting pre-approved lets sellers to know you’re the real deal. And, it lets you see what you can afford, so you focus on the right price points and choose the perfect one to go after with confidence.Save for a down payment (and then some!): Putting 20% of the purchase price down at your closing isn’t necessary, but it could help you in terms of better rates and overall monthly payments. It can also help you avoid paying for private mortgage insurance (PMI). It’s also wise to save for emergencies because once you’re in your new home, you never know what may suddenly need repair.

Rather than just prequalification, which is more like an estimate of what you can borrow, a pre-approval means the loan is much more likely to get through underwriting once you get a home under contract because the lender has already assessed your credit, income, debts, and assets.

Plus, if you find yourself competing for a property, being able to tell a seller you’re pre-approved can give you the advantage you need against others who are not.

Do your due diligence: Think you’ve found an area you like? Check out neighborhoods at different times of day, and be sure to notice traffic patterns. For example, is the home you like on a street drivers use to dodge traffic on Main Street. Will you encounter school drop-off or pick-up congestion that will make getting in or out of your driveway a hassle? How about early morning church bells or that firehouse whistle? Consider all these factors and anything else that may appeal to you or bother you personally as you drive past potential homes.

If you’re planning on buying soon, you may be competing with plenty of other buyers once Spring is in full swing. So, taking care of the items listed above can help you get the edge you need. Especially with the Spring real estate market getting its own head start!

Not sure where to get started …give me a call at (317) 625-0655!

Do you have a home to sell?? Be sure to check out back for next week’s blog.