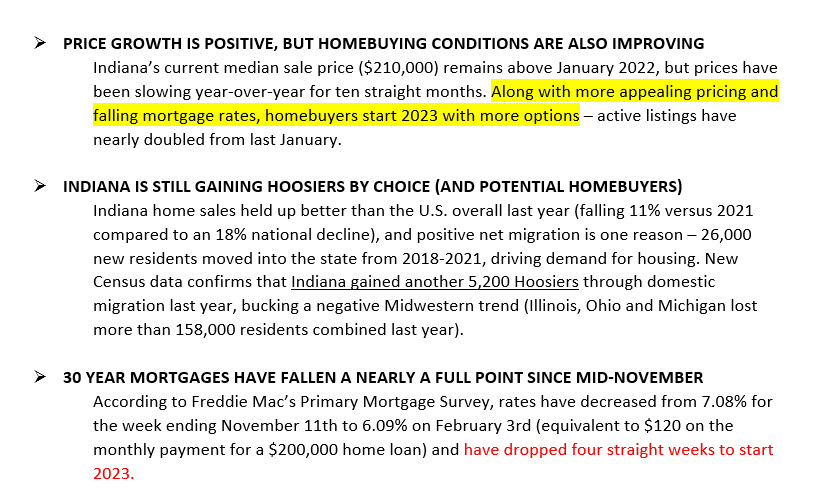

Boy, is that ❄️snow coming down. I hope you are enjoying it from the inside of your home. I have had a few questions from clients on how Seller Concessions work, so I wanted to share some details on how it can benefit both the Seller and the Buyer, esp in times like this.

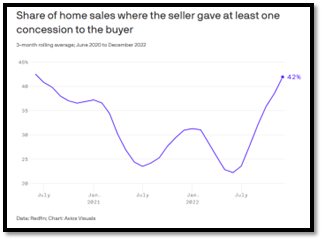

What Are Seller Concessions

Seller concessions are closing costs that the Seller has agreed to pay

Benefits for the Buyer

- Help make buying the home more affordable

- Reduce closing costs /cash needed

Benefits for the Seller

- Help make your home more accessible to buyers with varying budgets

- Expedite the home sale process

Want to hear more? Drop me a line (or text) at (317) 625-0655, and I will connect you with one of our trusted financing partners. Or head to our website. Knowledge is key!