As January comes to a close, I want to thank YOU for a remarkable 2022.

“We work harder to make good things happen for our clients!”

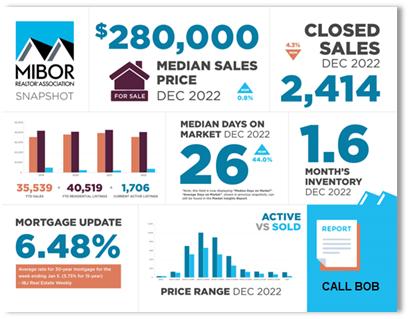

I tell my clients to stop listening to the nightly news. They are talking about home prices in places like Austin, Boise, and Phoenix. Our Local Market prices actually rose last month – Up 3K from November and 10% from a year ago. The median sales price increased in December to $280,000. Real Estate is Local! Click HERE for Full PDF Market Report

While Sales are Slowing :

It took an average 46 days to sell a house in December, 11 days longer than in November and almost double from a year ago. Sales were down 29% from a year ago. New listings are down as well (23% from last December).

Active Inventory is Growing:

Up 3,816 from 2,088 a year ago. Still only a 1.6 month supply. That’s over 2x what there was a year ago, but still a long way from being a balanced market.

During the past two years, we saw homes selling over the asking price but are now selling at 97.7% of the list- believe me when I say – a “normal” number.

Do you need some advice on what to do next..…Call or Text me (317) 625-0655. Let’s put together a winning strategy in this ever-changing market!!!

Happy New Year! I have had a few of my clients ask about these programs being offered by our partner, Caliber Home Loans, so I wanted to share them with you….

Whether you are an Active Buyer or Seller in 2023, there are some great programs available that can save you money. For example:

Rate Rollback Program where you can buy the house you want now and get a lower payment if rates go down in the next couple of years by refinancing. It can save you money in two ways when you refinance (1) on the monthly payment and (2) pay no lender fees

Lock ’n Shop or Lock’ n Sell programs where you lock in your financing. Spend more time and energy finding your perfect home and less time worrying about financing

Temporary Buydown is a mortgage option where homebuyers can purchase their homes with lower monthly mortgage payments to start. Many loan types, like VA, FHA, and conventional loans, allow buydowns

If you would like to dive a little deeper to see if one of these programs is viable for your situation, call or text me at (317) 625-0655. I am looking forward to serving you in 2023!