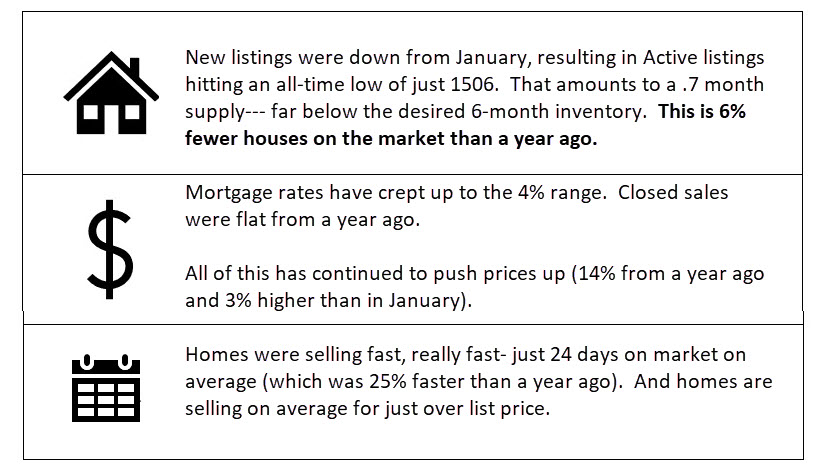

MIBOR just released February numbers for the Central Indiana housing market. The key takeaways are:

Download County Specific Market Reports Here

What are the EXPERTS saying:

“With inventory at a record low before the start of the spring selling season, we can expect the market to be challenging for buyers for these next few months. Working with a REALTOR® can help prospective homeowners to be prepared in making the best offer.” – Shelley Specchio, MIBOR CEO

When you are ready, give me a call at (317) 625-0655. No doubt, the market continues to overwhelm many buyers, though let me show you what is possible—ONE STEP AT A TIME.