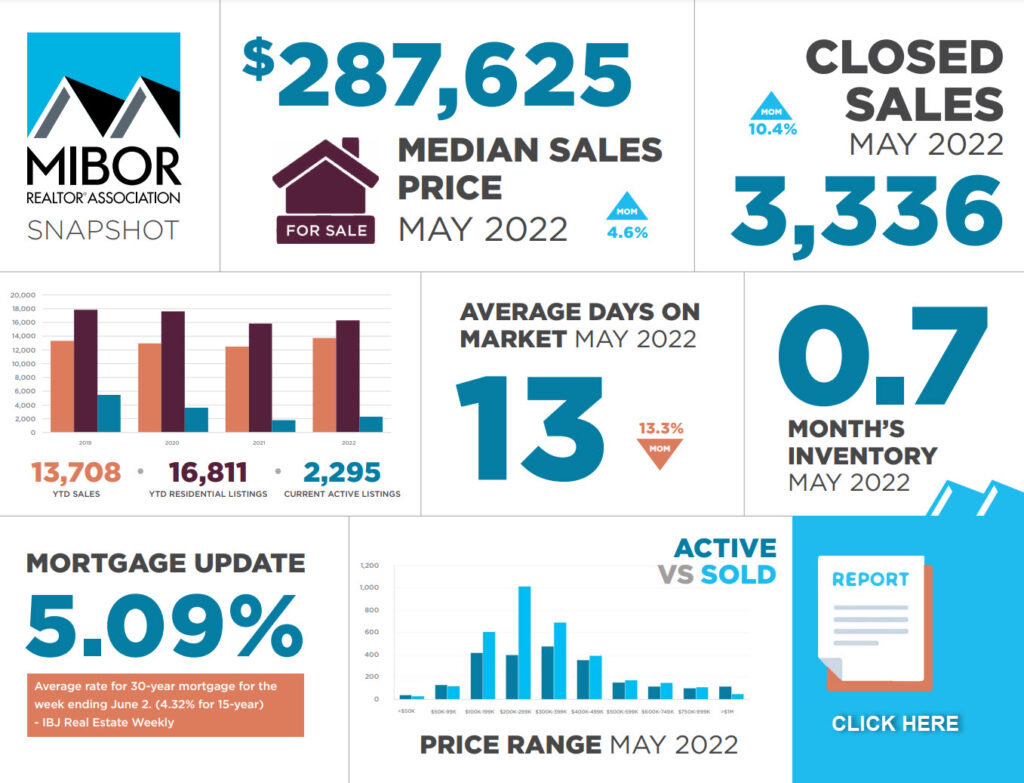

Prices are up 20% over a year ago and appear to be accelerating, with the average home now selling for an even 300k. (Call me if you want to sell this summer, it’s still looking good!)

Prices are up 20% over a year ago and appear to be accelerating, with the average home now selling for an even 300k. (Call me if you want to sell this summer, it’s still looking good!)

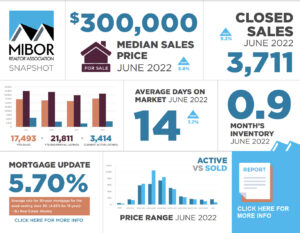

Closings were up 9% from May but down 6% from a year ago. (Not sure how to figure that one out!)

The BIG news may have been New Listings increased 16% from the previous month and 11% from a year ago. (That’s WELCOME NEWS for HOME BUYERS.)

Active inventory is now up a whopping 64% over last year this time!