NAR (National Association of Realtors) conducts an annual survey of home buyers and sellers who recently completed a transaction within the last 12 months.

One highlight that did not surprise me a bit was that BUYERS ARE MOVING FURTHER. The median distance purchasers moved from their previous homes reached an all-time high of 50 miles. Historically, the median distance moved has been between 10 and 15 miles.

Why the huge uptick? Buyers are being driven to the market to be closer to family and friends, with affordability at the top of their minds. Small towns and rural areas are now being considered as inventory is low.

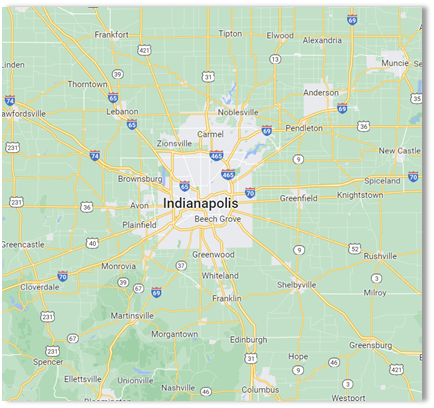

When you are ready, know that our service territory ➡️extends from Columbus and Brown County on the south to Tipton up north and from Greencastle to New Castle. L👀 k at that map! In recent years, we have sold homes in counties all over central Indiana.

Regardless of where you want to move— we can help you get the job done right. We work harder to make good things happen!