With the talk of a looming 2020 recession, I recently came across this article that I found quite interesting.

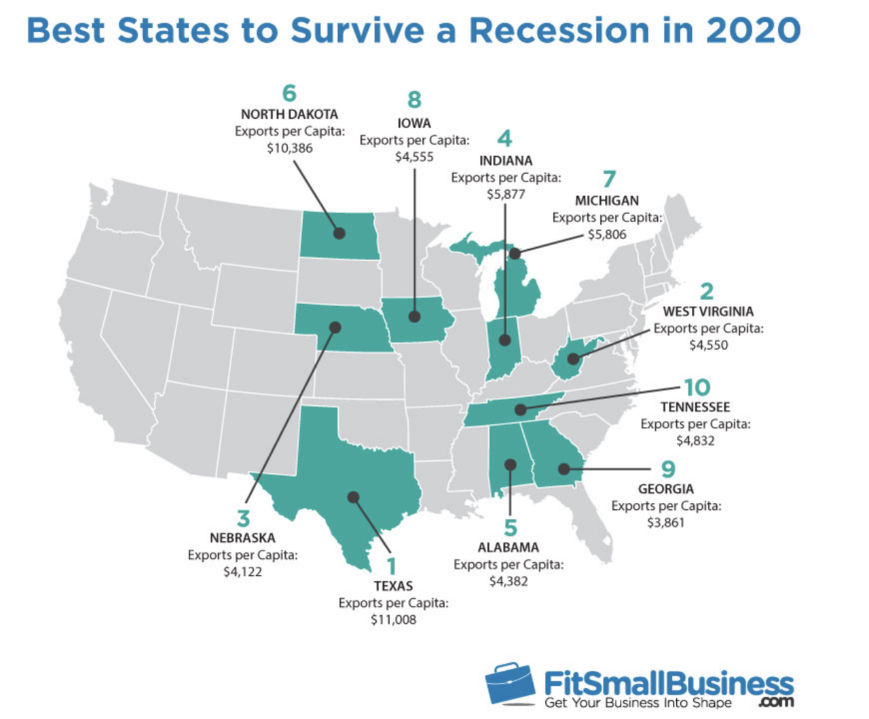

Fit Small Business just released the results of its 2019 study that dug into national and state-based economic data to rank each state on how best equipped they were to survive a recession in 2020. All of them boast business diversity and minimal per-capita debt, but the changes over the last two years were remarkable.

Here’s what they said about our beautiful state of Indiana.

“Indiana is No. 4 in our recent 2019 study from Fit Small Business, up from the 10th position in 2017. Indiana’s debt-to-income ratio dropped from 1.34 in 2017 to 1.165 in 2019, while its GDP grew from $273 billion in 2008 to $367 billion in 2019. Indiana also has the eighth-highest exports per capita at $4,122.

The real estate market has also evolved in Indiana since 2017 with a drop in median home value from $186,000 to $147,000 in 2019. While this indicates a drop in demand, it also suggests more affordable housing for residents—key for those who want to get back on their feet after a hard-hitting recession. Last, but certainly not least, Indiana boasts a low income tax rate of 3.23%—the nation’s fourth lowest.”

This is excellent news for the real estate market in Indiana! So if you are thinking of buying/selling, it may be the right time for you. Give me a call at 317-625-0655.

Want to dive deeper into the study? The following 11 metrics were analyzed and compared to their 2017 study. The full report can be found here

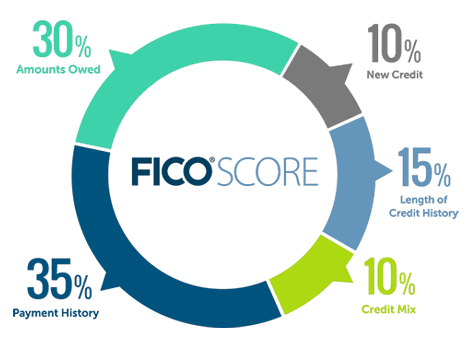

• Stabilization (aka surplus or emergency) funds available (15%)

• Economic strength and diversity (15%)

• Debt-to-income ratio (10%)

• Unemployment rate (10%)

• Median home value (10%)

• Exports per capita (10%)

• Export diversity (10%)

• Deposits per capita (7.5%)

• Average credit card debt (5%)

• State income tax rate (5%)

• 2008 recession performance (2.5%)

Until next time, make it a great day!